TLDR; Founders want to build big expansive products. In my opinion, starting to build a big product with lots of use-cases is the wrong approach and is very difficult to pull off. It's better to start planning your roadmap as a set of narrow overlapping use-cases with a tight narrative. We present a repeatable process to apply to your product roadmap to achieve product-market fit and wide adoption.

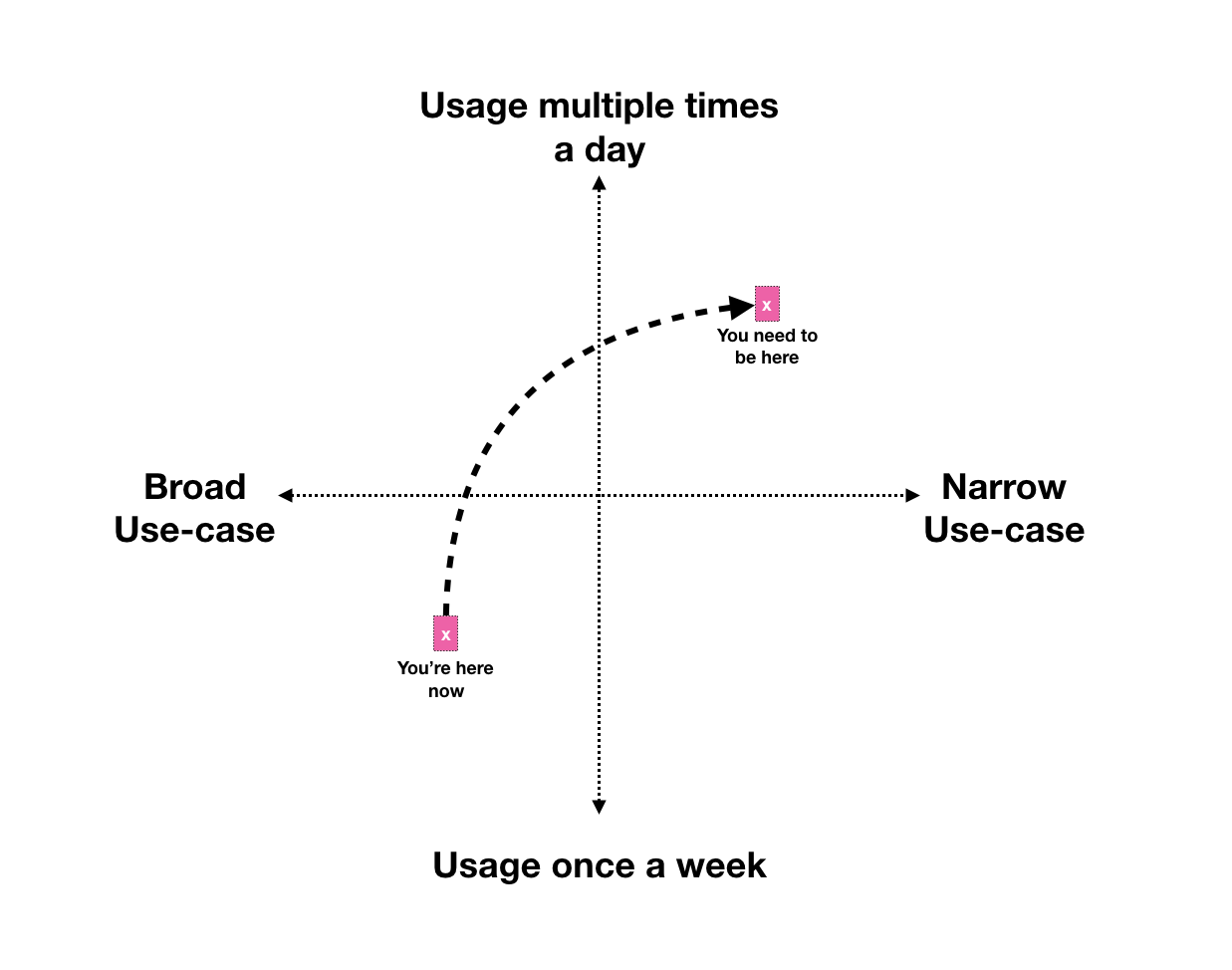

The outstanding 2x2 matrix

We will use the following infamous 2x2 matrix analogy to anchor our thinking:

If you're thinking of a problem to solve, you have four options:

- Broad use-case / Light usage

- Broad use-case / Heavy usage

- Narrow use-case / Light usage

- Narrow use-case / Heavy usage

Our thesis is that it's hard to build a product with broad use-cases from the get go. It's easier to target a narrow use-case and then gradually expand scope as your product evolves.

Why focus on retention and not growth?

It's still early days for DeFi.

DeFi has the potential to touch all seven billion people on the planet – and there's going to be a multitude of products to serve all kinds of use-cases. No one product can serve all needs. People are incredibly diverse – a small business owner in China has different financial needs compared to a college graduate in Canada about to join the workforce.

By all optimistic measures, there are about 100,000 end-users using DeFi today.

In my opinion, it's still early for the mass-market to adopt DeFi. There are a large number of unsolved usability, privacy and security issues that need to be resolved before marketing to a broader userbase is justified. It's not all doom-and-gloom either: on Ethereum there's a clear solution path to many of these problems. I'm confident that we are going to have a different landscape in just under six months.

So, why not take the time to research/iterate to the needs, aspirations, motivations and pain points of your target customer base before starting to focus on growing that userbase?

When DeFi takes off, you will be ready to capture that user growth sustainably.

The recipe for product-market fit

Note: This recipe is more geared towards dApps and consumer facing apps rather than protocols. We will have another follow up post for pick-and-shovel products like protocols, layer 1 chains and other infrastructure products.

Have a narrow and clear definition of the customer. In the DeFi space, it can be along two dimensions: a persona (eg: investor, trader, user, developer) and a geo-location (eg: Asia, English-speaking world).

Identify a financial use-case for this customer. It could be one of the verbs like "borrow", "trade", "lend", "bet", "earn" (or "steal" 👿👿👿 – sorry couldn't help myself.)

Build a prototype to solve for this use-case. At this stage you don't need a logo or even a marketing website.

Recruit a cohort of 5 people who fit that persona. Only after you've satisfied this cohort should your proceed to recruit another cohort. The recruitment processs will also teach you repeateable customer acquisition skills.

Resist the temptation of new revenue streams and new features. If you try to serve everyone, you serve no one.

Establish a tight loop with that cohort. Tighter the loop, the better it is. My choice of tools are Twitter direct messages, WhatsApp and Telegram. If a person is not willing to sign up for that level of intimacy, then they are not desperate for a solution. Cut them out of this cohort and you can come back to them when your product is more mature.

Rinse and repeat. You also need to keep an eye on retention - 40% weekly retention is a good place to start. We write about measuring retention further down in this post.

If you're not able to recruit a cohort of 5 people, or not able to reach your retention goal – you'll have to make changes. Either change the target persona or change the product.

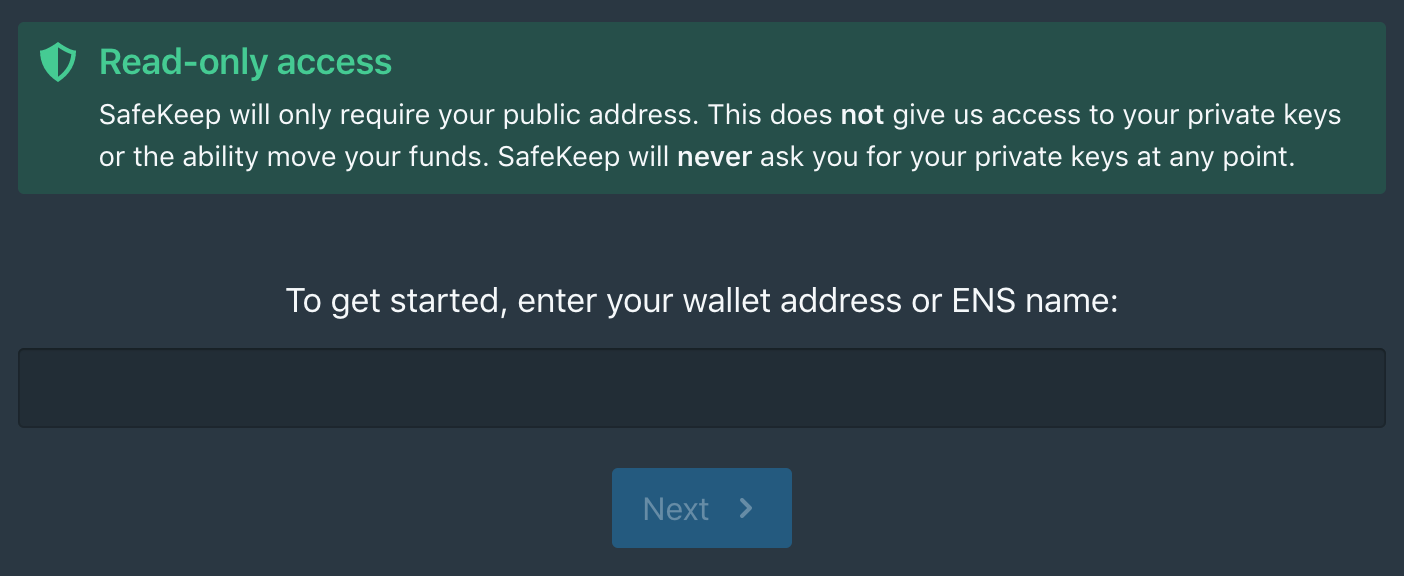

This is the exact process we use everyday for our DeFi record-keeping app SafeKeep.

How to measure retention

As you progress with your iterations, you should start to see your user base grow cohort-over-cohort. A side benefit of this process is that it has the potential to kick start word of mouth effects, specially if you have a memeable narrative.

Now that you have a tight control over who gets to use your product, the second item to focus on is retention. Keeping a close eye on retention ensures that you are continuing to solve a problem that's critical to your customer's workflow. If there's only light usage, they'll forgot about your product and either stop using it entirely or switch back to their previous workflow or another competing solution.

At the early stages, there are two primary ways to keep track of retention.

1. Product-Market fit survey

Every month or so, you can send each cohort a questionaire with one question and four choices:

“ **How will you feel if you could no longer use this product? **

- Very disappointed

- Somewhat disappointed

- Not disappointed

- Who are you / I no longer use your product

If more than 40% of your respondents answer "very disappointed" – congratulations, you now have product-market fit. The reason for breaking this down by cohorts is so that you can track your progress over time. You should be trending towards the 40% goal over time.

Features like push notifications can only marginally improve this number by 5% max – so if you're at 20% right now, go back to the drawing board. You're never going to be able to bridge that gap without rethinking the product.

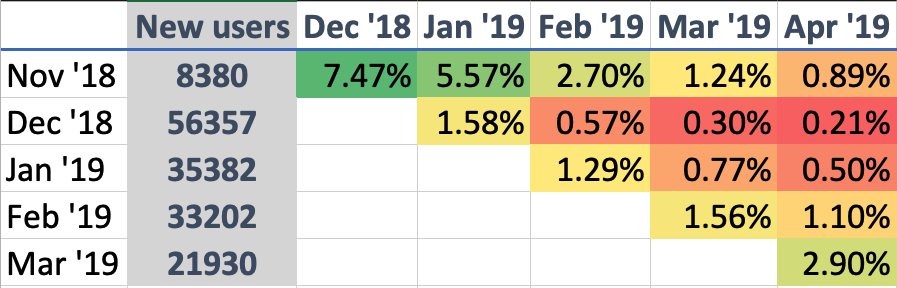

2. Cohort retention charts

Aggregate numbers like total volume or total number of users are just vanity metrics. To really understand if your product is picking or losing steam, you'll need to perform a cohort analysis.

Cohort analysis answers this – if 100 users sign up in a particular month, what percentage of them come back one month after signup, two months after signup, and so on. It's a way to group users who share a characteristic (i.e., signup in the same month) and study their performance over time.

In 2019, we performed a cohort analysis on Uniswap's traders. From that analysis, we found that the average monthly retention rate of traders is less than 2% (which meant that 98% of the addresses never came back for an interaction in a subsequent month.)

To actually perform a cohort analysis – you can use one of the many off the shelf tools with generous free plans. We've used both Mixpanel as well as Amplitude and recommend both.

In practice: Our journey to SafeKeep

SafeKeep solves the record-keeping and data availability gap for your DeFi transactions.

A few weeks ago, we started to build SafeKeep – a tool that solves the record-keeping and data availability gap for your DeFi transactions. Think of it as the "Download CSV" button for DeFi.

SafeKeep as a product is 1) easy to understand 2) straightforward to use 3) has a repeatable narrative. Within a few days of announcing our private beta, hundreds of DeFi investors have signed up to be included in our private beta.

But we didn't magically arrive at this product. There's a back story...

SafeKeep is powered by Covalent's API – a product we've been building for the last two years. It's very popular with wallets and dApps that want to show their users a more sophisticated data feed. But it's so much more.

Covalent is an Ethereum analytics product with no one specific use-case in mind. Over the years, we've helped companies with the following data needs:

- Growth accounting & due diligence before a fund-raise

- Generating on-chain alpha for investment officers

- Getting more accurate supply/borrow interest rates for various debt protocols

- Generating a "sources of funds" report for a financial institution

- Calculating Cost Basis / Profit and Loss

- Alerts for MakerDAO loan liquidations

- Data for planning capital requirements for bridging loans

- Mining DeFi transaction history for taxable events

- Peg stability for various Stablecoins

As you can imagine, the API is an advanced product that can be hard to explain to a general audience. It was even difficult to explain this product to smart contract developers. The product requires a fair bit of education before potential users were able to understand its value proposition. Because it was so flexible, it required customizations before you could derive value from it.

While applying our product-market fit recipe, we quickly ran into adoption issues. It was time to go back to the drawing board – and SafeKeep was born.

On the positive note, for users who understood the API value proposition, we are able to charge a lot of money. For certain kinds of blockchain data, Covalent's API is the only place to get it.

The question you may have – why not start with a product like SafeKeep from the start? The answer is straightforward – you cannot build a product like SafeKeep if not for Covalent's API.

Further thoughts

For the last couple of weeks, we have been offering "office hours" to the DeFi community brainstorming ideas on building sticky products. This post is a transcript from one such session with an entrepreneur.

Follow the conversation on Twitter

1/ For the last couple of weeks, we've been having "office hours" with entrepreneurs in the #DeFi community. The discussions were brainstorming sessions on building sticky products. The following is a transcript+case study from one such session. 🎙️A thread ⬇️ ⬇️ ⬇️— Ganesh Swami (@gane5h) February 3, 2020 <script async src="https://platform.twitter.com/widgets.js" charset="utf-8"></script>