In today’s digital era, where security breaches and fraudulent activities target online transactions in the modern digital age, there is a need for innovative solutions that can help protect and ensure the trustworthiness of the parties’ assets. Multi-signature contracts provide this solution as a form of calling in this bleak security and reliability landscape as it offers a mechanism that both can reduce risks and improve the reliability of transactions. Multi-signature contracts can be used in various domains, including cryptocurrency transactions, corporate governance, as well as decentralized finance. Through the use of multi-signatures, these contracts can guarantee security and transparency as well as accountability. Consequently, this minimizes the likelihood of misunderstanding and fraudulent transactions.

This guide is divided into two parts, focusing on multi-signature contracts. The first part provides an overview of multi-signature contracts, exploring their concept and significance. The second part offers a detailed guide on implementing a multi-signature contract yourself.

Why the Need for Multi-signature Contracts?

The evolution of digital transactions demands innovative solutions to new challenges. Multi-signature contracts emerge as a pivotal solution in this context, addressing critical concerns such as enhanced security and decentralized decision-making. Below, we delve into the reasons why multi-signature contracts are becoming indispensable in various sectors.

Enhanced Security

Single-signature systems, where a transaction or decision requires approval from only one party, present significant security risks. These systems are vulnerable to a range of threats, including hacking, theft, and unauthorized access. The simplicity that makes single-signature systems user-friendly also makes them an easy target for malicious actors.

Consider the scenario of a high-profile digital currency exchange that suffered a massive security breach due to reliance on a single-signature wallet system. Hackers were able to gain access to the private key of the wallet, leading to the theft of millions of dollars worth of digital currency. This incident, among others, highlights the inherent risks of single-signature systems and underscores the need for more secure alternatives.

Decentralized Decision Making

In many contexts, from corporate governance to crypto exchanges, the involvement of multiple stakeholders in decision-making processes is crucial. Multi-signature wallets facilitate this by requiring approval from multiple parties before a transaction or decision can be executed. This not only ensures a broader consensus but also enhances the legitimacy and acceptance of the decision.

Imagine a scenario in a blockchain startup where the release of funds for a new project requires consensus among the core team members. A multi-signature contract can be set up to require signatures from at least three out of five team members, ensuring that no single individual can unilaterally decide on the use of funds.

How Multi-signature Contracts Work

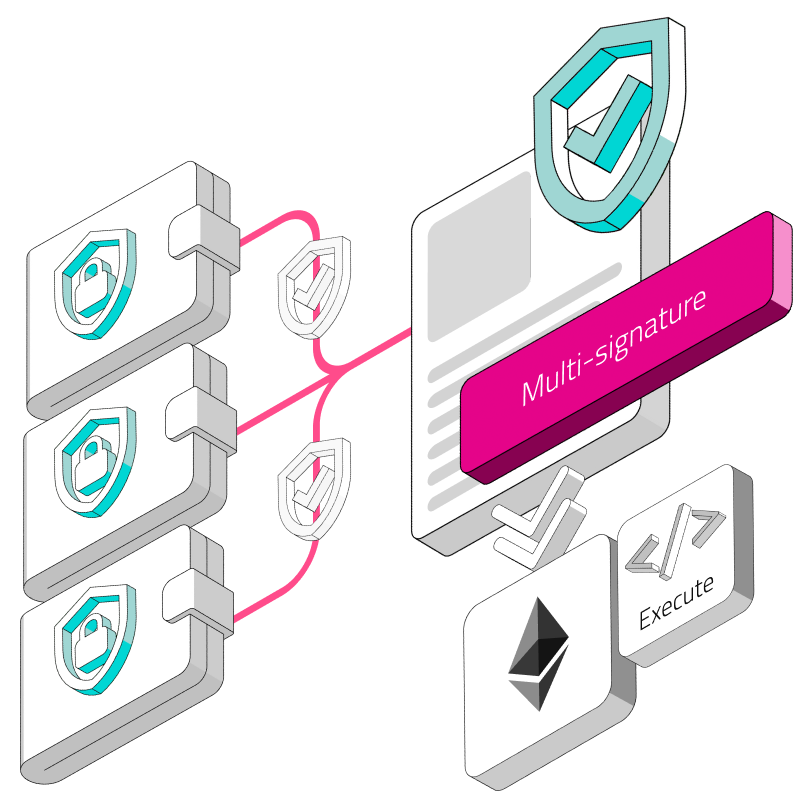

Multi-signature contracts, often referred to as multisig, represent a digital agreement that requires multiple signatures or approvals before a transaction or action can be executed. This mechanism is particularly prevalent in the realm of cryptocurrencies and blockchain technology but is also applicable in various other sectors requiring enhanced security and collaborative decision-making processes. Here, we delve into the detailed workings of multi-signature contracts, from initiation to execution.

Basics Mechanisms

At its core, a multi-signature contract involves a digital wallet that is associated with more than one private key or user. Unlike traditional single-signature contracts, which require only one signature to authorize a transaction, multisig contracts mandate approvals from multiple parties, as predefined in the contract's code.

For instance, a 2-of-3 multisig contract requires two out of three designated parties to provide their signatures for a transaction to proceed. This setup enhances security by distributing trust among multiple entities and ensures that no single party can unilaterally make decisions or execute transactions.

Transaction Initiation: The process begins when a user initiates a transaction, such as transferring digital assets or executing a specific action within a contract. This initiation is akin to creating a transaction proposal, outlining the intended action, the recipient, and the amount in the case of fund transfers.

Signature Collection (Signers): Once the transaction is initiated, it enters a pending state, awaiting the required signatures. The designated signers are notified of the pending transaction and can review the details before deciding to approve or reject it. Each signer uses their private key to sign the transaction digitally. This signature process is secure and ensures that the approval is verifiable and non-repudiable. The digital signatures are collected and stored alongside the transaction, serving as an immutable record of each party's approval.

Execution Process: After the requisite number of signatures has been confirmed, the transaction can move forward to execution. The execution process varies depending on the platform or technology underlying the multi-signature contract. In the context of blockchain, the transaction, now validated by the required signatures, is broadcast to the network. It is then verified by miners or validators (depending on the consensus mechanism) and, once confirmed, is added to the blockchain.

Use Cases

Multi-signature contracts, with their unique ability to require multiple signatures for authorization, find application across various domains, each contributing to enhancing security, trust, and accountability in transactions. Let's delve into some use cases where multi-signature contracts play a role:

Blockchain Wallet Security: In blockchain, where digital assets are susceptible to theft and unauthorized access, multi-signature contracts serve as a robust security measure. By requiring multiple signatures from designated parties to authorize transactions, multi-signature wallets enhance the security of cryptocurrency holdings. Each transaction must undergo scrutiny and validation from multiple signers, mitigating the risk of fraudulent activities and unauthorized transfers. Whether it's for individual investors or cryptocurrency exchanges, multi-signature wallets provide peace of mind and safeguard digital assets against potential threats.

Escrow Services: Escrow services play a crucial role in facilitating secure transactions, particularly in high-value transactions involving goods or services. Multi-signature contracts add an extra layer of trust and reliability to escrow arrangements by requiring multiple parties to authorize the release of funds. This ensures that transactions proceed only when all stakeholders have given their consent, minimizing the risk of disputes, breaches of contract, or fraudulent activities.

Corporate Governance: In corporate governance, where decision-making processes and financial transactions carry significant implications, multi-signature contracts offer a powerful tool for enhancing transparency, accountability, and compliance. By requiring multiple signatures for critical actions such as fund transfers, contract approvals, or corporate resolutions, multi-signature contracts prevent unilateral actions and ensure consensus among key stakeholders. This not only mitigates the risk of fraud or embezzlement but also fosters a culture of collaboration and shared responsibility within organizations.

No-Code Tools for Creating Multi-Signature Wallets

The advent of no-code platforms has significantly lowered the barrier to entry for utilizing advanced technologies such as multi-signature (multisig) wallets. These platforms offer user-friendly interfaces and streamlined processes, enabling individuals and organizations to leverage the security benefits of multisig wallets without the need for extensive coding knowledge. Here are some notable no-code tools that facilitate the creation and management of multisig wallets:

Safe (formerly Gnosis Safe)

Safe is a prominent platform that offers a highly secure and flexible way to manage digital assets and interact with decentralized applications (dApps) without requiring deep technical expertise. It is designed to enhance the security of Ethereum and other EVM-compatible blockchain assets through a multisig approach.

Notable features of Safe include:

User-Friendly Interface: Safe provides an intuitive interface that simplifies the process of setting up and managing a multisig wallet, making it accessible to users with varying levels of technical proficiency.

Customizable Security: Users can define the number of signatures required for transaction approval, allowing for tailored security protocols that match the specific needs of an organization or group.

Integrated Services: Safe supports integration with a wide range of dApps and services, enabling users to interact with the broader blockchain ecosystem securely and efficiently.

Argent X

Argent X is known for its simplicity and ease of use, catering especially to those new to the world of blockchain and cryptocurrencies. It offers a straightforward approach to creating and managing multisig wallets, focusing on user experience and security.

Notable features of Argent X include:

Simplicity and Accessibility: Argent X emphasizes a clean, user-friendly interface that demystifies the process of setting up a multisig wallet, making it approachable for beginners.

Smart Contract Integration: Argent X allows users to interact with smart contracts directly from their wallet, facilitating seamless engagement with dApps and other blockchain-based services.

Conclusion

In conclusion, the proliferation of multisig contracts in the blockchain space has significantly enhanced security and trust in digital transactions. By requiring multiple signatures to authorize transactions, these contracts have introduced a robust layer of protection against unauthorized access and fraud. As a result, multisig contracts have become a cornerstone for businesses, organizations, and individuals seeking to safeguard their digital assets, demonstrating their critical role in the advancement and adoption of secure, decentralized technologies.